Chapter 8 Competitive Firms and Markets

MULTIPLE CHOICE QUESTIONS

1) Economists define a market to be competitive when the firms

A) spend large amounts of money on advertising to lure customers away from the competition.

B) watch each other's behavior closely.

C) are price takers.

D) All of the above.

Answer: C

Diff: 0

Topic: Competition

2) If consumers view the output of any firm in a market to be identical to the output of any other firm in the market, the demand curve for the output of any given firm

A) will be identical to the market demand curve.

B) will be horizontal.

C) will be vertical.

D) cannot be determined from the information given.

Answer: B

Diff: 0

Topic: Competition

3) In the absence of any government regulation on price, if a firm has no power to set price on its own, one can safely conclude

A) the demand curve for the firm's product is horizontal.

B) there are many firms in the industry.

C) the market is in long-run equilibrium.

D) the firms in this industry are not profitable.

Answer: A

Diff: 2

Topic: Competition

4) In a perfectly competitive market,

A) firms can freely enter and exit.

B) firms sell a differentiated product.

C) transaction costs are high.

D) All of the above.

Answer: A

Diff: 0

Topic: Competition

5) In a competitive market, if buyers did not know all the prices charged by the many firms,

A) all firms still face horizontal demand curves.

B) firms sell a differentiated product.

C) demand curves can be downward sloping for some or all firms.

D) the number of firms will most likely decrease.

Answer: C

Diff: 1

Topic: Competition

6) Many car owners and car dealers describe their different cars for sale in the local newspapers and list their asking price. Many people shopping for a used car consider the different choices listed in the paper. The market for used cars could be described as

A) competitive.

B) perfectly competitive.

C) non-competitive.

D) having high transaction costs.

Answer: A

Diff: 1

Topic: Competition

7) Many car owners and car dealers describe their different cars for sale in the local newspapers and list their asking price. Many people shopping for a used car consider the different choices listed in the paper. The absence of which condition prohibits this market from being described as perfectly competitive?

A) Buyers and sellers know the prices.

B) Firms freely enter and exit.

C) Transaction costs are low.

D) Consumer believes all firms sell identical products.

Answer: D

Diff: 1

Topic: Competition

8) If a firm operates in a perfectly competitive market, then it will most likely

A) advertise its product on television.

B) settle for whatever price is offered.

C) have a difficult time obtaining information about the market price.

D) have an easy time keeping other firms out of the market.

Answer: B

Diff: 1

Topic: Competition

9) If a firm happened to be the only seller of a particular product, it might behave as a price taker as long as

A) buyers have full information about the firm's price.

B) the transaction costs of doing business with this firm are low.

C) there are many buyers.

D) there is free entry and exit.

Answer: D

Diff: 2

Topic: Competition

10) The demand curve an individual competitive firm faces is known as its

Answer: C

Diff: 0

Topic: Competition

11) If a firm makes zero economic profit, then the firm

Answer: C

Diff: 1

Topic: Profit Maximization

12) If marginal revenue equals marginal cost, the firm is maximizing profits as long as

A) the resulting profits are positive.

B) marginal cost exceeds marginal revenue for greater levels of output.

C) the average cost curve lies above the demand curve.

D) All of the above are required.

Answer: B

Diff: 2

Topic: Profit Maximization

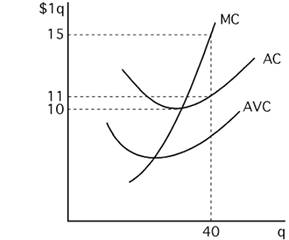

Figure 8.1

13) Figure 8.1 shows the cost curves for a competitive firm. If the firm is to earn economic profit, price must exceed

A) $0.

B) $5.

C) $10.

D) $11.

Answer: C

Diff: 1

Topic: Profit Maximization

14) Figure 8.1 shows the cost curves for a competitive firm. If the firm is to operate in the short run, price must exceed

A) $0.

B) $5.

C) $10.

D) $11.

Answer: B

Diff: 1

Topic: Profit Maximization

15) Figure 8.1 shows the cost curves for a competitive firm. If the market price is $15 per unit, the firm will earn profits of

A) $0.

B) $4.

C) $40.

D) $160.

Answer: D

Diff: 1

Topic: Profit Maximization

16) A firm will shut down in the short run if

A) total fixed costs are too high.

B) total revenue from operating would not cover all costs.

C) total revenue from operating would not cover variable costs.

D) total revenue from operating would not cover fixed costs.

Answer: C

Diff: 1

Topic: Profit Maximization

17) If a competitive firm maximizes short-run profits by producing some quantity of output, which of the following must be true at that level of output?

A) p = MC.

B) MR = MC.

C) p > AVC.

D) All of the above.

Answer: D

Diff: 1

Topic: Profit Maximization

18) If a competitive firm maximizes short-run profits by producing some quantity of output, which of the following must be true at that level of output?

A) p > MC.

B) MR > MC.

C) p > AVC.

D) All of the above.

Answer: C

Diff: 1

Topic: Profit Maximization

19) If a firm finds that it maximizes short-run profits by shutting down, which of the following must be true?

A) p < AVC for all levels of output.

B) p < AVC only for the level of output at which p = MC.

C) p < AVC only if the firm has no fixed costs.

D) The firm will earn zero profit.

Answer: A

Diff: 1

Topic: Profit Maximization

20) If a profit-maximizing firm finds that, at its current level of production, MR > MC, it will

A) earn greater profits than if MR = MC.

B) increase output.

C) decrease output.

D) shut down.

Answer: B

Diff: 1

Topic: Profit Maximization

21) If a profit-maximizing firm finds that, at its current level of production, MR < MC, it will

A) decrease output.

B) increase output.

C) shut down.

D) operate at a loss.

Answer: A

Diff: 1

Topic: Profit Maximization

22) The competitive firm's supply curve is equal to

A) its marginal cost curve.

B) the portion of its marginal cost curve that lies above AC.

C) the portion of its marginal cost curve that lies above AVC.

D) the portion of its marginal cost curve that lies above AFC.

Answer: C

Diff: 1

Topic: Competition in the Short-run

23) If a firm is a price taker, then its marginal revenue will always equal

A) price.

B) total cost.

C) zero.

D) one.

Answer: A

Diff: 1

Topic: Competition in the Short Run

24) An increase in the cost of an input will result in

A) a leftward shift in the firm's supply curve.

B) an upward shift of the firm's marginal cost curve.

C) a leftward shift of the market supply curve.

D) All of the above.

Answer: D

Diff: 1

Topic: Competition in the Short Run

25) When the production of a good involves several inputs, an increase in the cost of

one input will cause total costs to

Answer: B

Diff:1

Topic: Competition in the Short-Run

26) If a competitive firm is in short-run equilibrium, then

A) profits equal zero.

B) it will not operate at a loss.

C) an increase in its fixed cost will have no effect on profit.

D) an increase in its fixed cost will have no effect on output.

Answer: D

Diff: 1

Topic: Competition in the Short Run

27) Suppose TC = 10 + (0.1 * q2). If p = 10, the firm's profits will be

A) 240.

B) 250.

C) 260.

D) -10 because the firm will shut down.

Answer: A

Diff: 1

Topic: Competition in the Short Run

28) Suppose TC = 10 + (0.1 * q2). If there are 100 identical firms in the market, the market supply curve is

A) Q = 1000 * p.

B) Q = 500 * p.

C) Q = 100 * p.

D) Q = 10.

Answer: B

Diff: 1

Topic: Competition in the Short Run

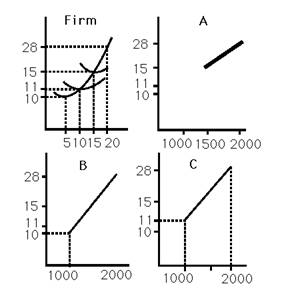

Figure 8.2

29) Figure 8.2 shows the cost curves for a typical firm in a market and three possible market supply curves. If there are 100 identical firms, the market supply curve is best represented by

A) curve A.

B) curve B.

C) curve C.

D) Either curve A or B, but definitely not C.

Answer: C

Diff: 1

Topic: Competition in the Short Run

30) If a firm is currently in short-run equilibrium earning a profit, what impact will a lump-sum tax have on its production decision?

A) The firm will decrease output to earn a higher profit.

B) The firm will increase output but earn a lower profit.

C) The firm will not change output but earn a lower profit.

D) The firm will not change output and earn a higher profit.

Answer: C

Diff: 1

Topic: Competition in the Short Run

31) Suppose that once a well is dug, water flows out of it continuously without any additional effort. Customers collect their water and pay a per gallon fee when they leave the site of the well. In the short run, the competitive firm in this market

A) will not shut down because variable costs are zero.

B) has no fixed costs.

C) faces diminishing marginal returns.

D) can act as a price setter.

Answer: A

Diff: 1

Topic: Competition in the Short Run

32) Suppose that once a well is dug, water flows out of it continuously without any additional effort. Customers collect their water and pay a per gallon fee when they leave the site of the well. In the short run, the competitive firm in this market

A) has no variable costs.

B) has no fixed costs.

C) will shut down.

D) can produce water at no cost.

Answer: A

Diff: 2

Topic: Competition in the Short Run

33) If a competitive firm cannot earn profit at any level of output during a given short-run period, then which of the following is LEAST likely to occur?

A) It will shut down in the short run and wait until the price increases sufficiently.

B) It will exit the industry in the long run.

C) It will operate at a loss in the short run.

D) It will minimize its loss by decreasing output so that price exceeds marginal cost.

Answer: D

Diff: 2

Topic: Competition in the Short Run

34) In deciding whether to operate in the short run, the firm must be concerned with the relationship between price of the output and

A) total cost.

B) average variable cost.

C) total fixed cost.

D) the number of buyers.

Answer: B

Diff: 1

Topic: Competition in the Short Run

35) In the long run, profits will equal zero in a competitive market because of

A) constant returns to scale.

B) identical products being produced by all firms.

C) the availability of information.

D) free entry and exit.

Answer: D

Diff: 1

Topic: Competition in the Long Run

36) Assuming a horizontal long-run market supply curve, which of the following statements is (are) TRUE about competitive firms in the long run?

A) p = MC

B) p = AC

C) profit = 0

D) All of the above.

Answer: D

Diff: 1

Topic: Competition in the Long Run

37) Long-run market supply curves are upward sloping if

A) firms are identical.

B) the number of firms is restricted in the long run.

C) input prices fall as the industry expands.

D) All of the above.

Answer: B

Diff: 1

Topic: Competition in the Long Run

38) Long-run market supply curves are downward sloping if

A) firms are identical.

B) the number of firms is restricted in the long run.

C) input prices fall as the industry expands.

D) All of the above.

Answer: C

Diff: 1

Topic: Competition in the Long Run

39) If firms in a competitive market are not identical, then the long-run market supply curve will be

A) horizontal.

B) upward sloping.

C) downward sloping.

D) undetermined.

Answer: B

Diff: 1

Topic: Competition in the Long Run

40) Suppose that for each firm in the competitive market for potatoes, long-run average cost is minimized at $0.20 per pound when 500 pounds are grown. If the long-run supply curve is horizontal, then

A) some firms will enjoy long-run profits because they operate at minimum average cost.

B) the long-run price will be $0.20 per pound.

C) each consumer will purchase $100 worth of potatoes.

D) the long-run price will be set just above $0.20 per pound.

Answer: B

Diff: 1

Topic: Competition in the Long Run

41) Suppose that for each firm in the competitive market for potatoes, long-run average cost is minimized at $0.20 per pound when 500 pounds are grown. The demand for potatoes is Q = 10,000/p. If the long-run supply curve is horizontal, then how many firms will this industry sustain in the long run?

A) 0

B) 100

C) 50,000

D) There is not enough information to answer.

Answer: B

Diff: 1

Topic: Competition in the Long Run

42) Suppose that for each firm in the competitive market for potatoes, long-run average cost is minimized at $0.20 per pound when 500 pounds are grown. The demand for potatoes is Q = 10000/p. If the long-run supply curve is horizontal, then how much will consumers spend, in total, on potatoes?

A) $0

B) $500

C) $10,000

D) $50,000

Answer: C

Diff: 1

Topic: Competition in the Long Run

43) Suppose that for each firm in the competitive market for potatoes, long-run average cost is minimized at $0.20 per pound when 500 pounds are grown. The demand for potatoes is Q = 10000/p. If the long-run supply curve is horizontal, then how many pounds of potatoes will be consumed in total?

A) 0

B) 500

C) 10,000

D) 50,000

Answer: D

Diff: 1

Topic: Competition in the Long Run

44) In the long run, competitive firms MUST be profit maximizers because if they do not maximize profits

A) they will not survive.

B) they will not be price takers.

C) they will attract entry.

D) the profits that they do earn will only cover variable costs.

Answer: A

Diff: 1

Topic: Zero Profit for Competitive Firms in the Long Run

45) Long-run economic rent or profit do not exist for fixed factors like land because,

Answer: A

Diff: 1

Topic: Zero Profit for Competitive Firms in the Long Run

TRUE/FALSE/EXPLAIN

1) A market is perfectly competitive even if firms have the ability to set their own price as long as the price difference reflects differences in the product.

Answer: False. If the market is perfectly competitive, there are no differences in the product.

Diff: 0

Topic: Competition

2) Even though fixed costs do not affect the output decision, an increase in fixed costs results in a wider range of prices for which the firm operates at a loss.

Answer: True. An increase in fixed costs will shift AC upward but leave AVC unchanged. The gap between AVC and AC represents prices at which the firm will operate at a loss.

Diff: 1

Topic: Profit Maximization

3) If a firm cannot earn profits in the short run, it will shut down.

Answer: False. A firm will operate at a loss if the loss incurred from production is less than the loss incurred from shutting down. Even if the firm shuts down, it still must pay its fixed costs.

Diff: 1

Topic: Profit Maximization

4) A competitive firm's supply curve is identical to its marginal cost curve.

Answer: False. The statement is only partly correct. The supply curve is only that portion that lies above AVC.

Diff: 1

Topic: Competition in the Short Run

5) If firms in a competitive market are identical, the long-run market supply curve is horizontal.

Answer: False. The horizontal long-run supply curve also requires that factor prices do not increase with industry expansion and that the number of firms is not restricted.

Diff: 1

Topic: Competition in the Long Run

PROBLEMS

1) Suppose there are 20 competitive firms in a market. The supply curve of each firm is q = 2p. The market demand is Q = 200 - 2p. What is the residual demand curve facing a typical firm?

Answer: The residual demand curve is equal to the market demand curve minus the supply of all the other firms. The supply of the other 19 firms is 38p. The residual demand is 200-40p.

Diff: 2

Topic: Profit Maximization

2) If a firm operates at a loss, the loss is equal to TC - TR. If the firm shuts down instead, its loss is equal to FC. Given this, show that price must exceed AVC for the firm to operate at a loss and not shut down.

Answer: The firm operates at a loss if TC -TR < FC. Adding TR - FC to both sides yields VC < TR. Dividing by q yields AVC < p. That is, the firm will operate at a loss as long as AVC < p.

Diff: 1

Topic: Profit Maximization

3) Suppose a firm has the following total cost function TC = 100 + 2q2. If price equals $20, what is the firm’s output decision? What are its short-run profits?

Answer: MC = 4q. To maximize profit, set 20 = 4q, or q = 5. Profit = TR - TC = (20 * 5) - (100 + 50) = -50. Since FC = 100, the firm will produce 5 units and operate at a loss of 50 rather than shutting down and incurring a loss of 100.

Diff: 1

Topic: Profit Maximization

4) Suppose a firm has the following total cost function: TC = 100 + 4q2. What is the minimum price necessary for the firm to earn profit? Below what price will the firm shut down in the short run?

Answer: AC = 100/q + 4q. This is minimized when dAC/dq = 0, or -100/q2 + 4 = 0. Solving yields q = 5 and AC = 40. Thus, a price greater than $40 is required for the firm to earn profit.

AVC = 4q and MC = 8q. Since AVC is below MC for levels of output, AVC will be less than price for all levels of output. The firm will not shut down in the short run.

Diff: 1

Topic: Profit Maximization

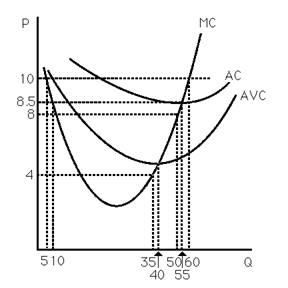

Figure 8.3

5) Figure 8.3 shows the cost curves for a typical firm in a competitive market. Note that if p = 10, then MC = p at both q = 5 and q = 60. Can they both yield maximum profit? Explain.

Answer: No, at q = 5, p = MC, but this is not profit maximization; it is profit minimization. Profits expand as output increases since MR > MC for higher levels of output. At q=60, an increase or decrease in output causes profits to fall, so this is the profit-maximizing q. Thus, one way of wording the "second order condition" for profit maximization is that MC must cut the demand curve from below.

Diff: 2

Topic: Profit Maximization

6) Figure 8.3 shows the cost curves for a typical firm in a competitive market. From the graph, estimate the firm's profits when price equals $10 per unit.

Answer: When price = 10, p =MC when q =60. TR =600. The AC is just above 8.5, say 8.6. This yields TC = 516. The firm's profit is estimated to be around $84.

Diff: 1

Topic: Competition in the Short-run

7) Figure 8.3 shows the cost curves for a typical firm in a competitive market. If there are 200 identical firms, estimate the market quantity supplied when p = 4, 8, and 10.

Answer: When p =4, p < AVC so no firms will produce. At p = 8, each firm produces 50 units at a loss. At p = 10, each firm produces 60 units. The market quantity supplied at each price is:

p Q

4 0

8 10,000

10 12,000

Diff: 1

Topic: Competition in the Short Run

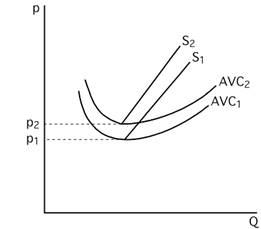

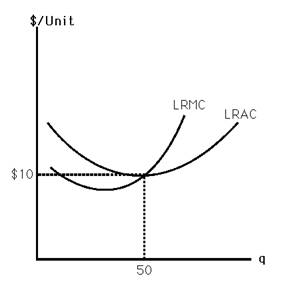

Figure 8.4

8) Draw a graph that shows how the short-run shut-down price changes when an input price increases.

Answer: See figure 8.4

Diff: 1

Topic: Competition in the Short Run

9) Suppose there are 1000 identical wheat farmers. For each, TC =10 + q2. Derive the market supply curve.

Answer: For each MC = 2q and AVC = q. Thus MC > AVC for all levels of output. The firm sets p = 2q or q =0.5p. Since there are 1000 firms each producing q, market supply equals Q = 500p.

Diff: 1

Topic: Competition in the Short Run

10) Suppose there are 1000 identical wheat farmers. For each, TC =10 + q2. Market demand is Q = 600,000 - 100p. Derive the short-run equilibrium Q, q, and p. Does the typical firm earn a short-run profit?

Answer: The firm's supply is q = 0.5p; market supply is Q = 500p. Market equilibrium can be found as 500p = 600,000 - 100p, or 600p =600,000, so p =1,000 and Q = 500,000. q = 0.5p = 500. Profit = (500* 1,000) - (10 + 250,000) = 249,990. Each firm earns a profit.

Diff: 1

Topic: Competition in the Short Run

Figure 8.5

11) Figure 8.5 shows the long-run cost curves for a typical firm in a competitive market. If the number of firms is unrestricted and input costs are constant, derive the long-run market supply curve.

Answer: The long-run market supply curve is horizontal at a price of $10 per unit.

Diff: 0

Topic: Competition in the Long Run

12) All the supply of peppermint oil is produced from mint plants grown in one county

by several competitive growers (the number of growers is not limited). The quality of land in the county varies greatly. Would you expect the long-run market supply curve to slope upward, downward, or remain constant? Why?

Answer: The long-run market supply curve will slope up because the growers have different costs. Those growers with poor-quality land have a higher average cost of production. The horizontal sum of the individual supply curves will slope up.

Diff:1

Topic: Competition in the Long Run

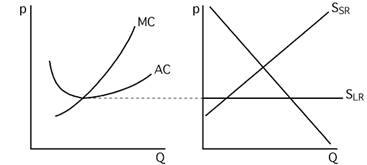

Figure 8.6

13) Suppose an industry has no fixed costs. Draw two graphs side by side for the

industry. In the left graph draw a U-shaped average cost curve and the corresponding marginal cost curve. In the right graph, draw a downward sloping market demand curve. Also in the right graph, draw a short-run supply curve that would generate positive profit, and the long-run supply curve that would result.

Answer: See Figure 8.6.

Diff: 2

Topic: Competition in the Long Run

14) Suppose all firms in a competitive market are currently in both short-run and long-run equilibrium. What impact will a lump sum tax have on each firm in the short run? in the long run?

Answer: In the short run, the lump sum tax represents a fixed cost. The firm's output decision is unchanged, but its profits decrease. In the long run, the tax raises the LRAC of each firm, but not MC. Minimum AC is higher, so price is higher. With a higher price, each firm produces a greater quantity, but the higher price means less quantity is demanded in total; thus, the number of firms will decrease.

Diff: 2

Topic: Competition in the Long Run

15) Suppose market demand is Q = 1000 - 4p. If all firms have LRAC = 50 - 5q + q2, how many firms will there be when this industry is in long-run equilibrium?

Answer: The long-run market supply curve is horizontal at the minimum LRAC. LRAC is minimized when -5 + 2q = 0 or q =2.5. At this level of output, LRMC = LRAC = 43.75. At this price, 825 units are demanded. If each firm produces 2.5 units in the long run, then 330 firms will be in this market.

Diff: 2

Topic: Competition in the Long Run

16) Even if two competitive firms in the same market have different production technologies, they will each earn long-run zero profits. Why?

Answer: The firm that has more productive resources will have the cost of those resources bid up by the marketplace. The more productive the resource, the more expensive it will be. This price is bid up until the firm's profits are zero. The firm with less productive resources will also have zero profits because it is not paying as much for its resources. There is no such thing as a free lunch —or a free productivity gain.

Diff: 2

Topic: Zero Profit for Competitive Firms in the Long Run

Source: http://static.gest.unipd.it/~birolo/didattica08/materiale07/materiale_Perloff/testbank-1/tbch08.doc

Web site to visit: http://static.gest.unipd.it

Author of the text: not indicated on the source document of the above text

If you are the author of the text above and you not agree to share your knowledge for teaching, research, scholarship (for fair use as indicated in the United States copyrigh low) please send us an e-mail and we will remove your text quickly. Fair use is a limitation and exception to the exclusive right granted by copyright law to the author of a creative work. In United States copyright law, fair use is a doctrine that permits limited use of copyrighted material without acquiring permission from the rights holders. Examples of fair use include commentary, search engines, criticism, news reporting, research, teaching, library archiving and scholarship. It provides for the legal, unlicensed citation or incorporation of copyrighted material in another author's work under a four-factor balancing test. (source: http://en.wikipedia.org/wiki/Fair_use)

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

The following texts are the property of their respective authors and we thank them for giving us the opportunity to share for free to students, teachers and users of the Web their texts will used only for illustrative educational and scientific purposes only.

All the information in our site are given for nonprofit educational purposes

The information of medicine and health contained in the site are of a general nature and purpose which is purely informative and for this reason may not replace in any case, the council of a doctor or a qualified entity legally to the profession.

www.riassuntini.com